How we’re funded

We’re a self-funded medical research charity. But what does ‘self-funded’ mean?

In the simplest of terms, we don’t rely on fundraising or external grants to support our work. Instead, we have several of our own income sources.

Our income sources

A fundamental source of our income comes from our investment portfolio. As of December 2023, this stood at £1.13 billion.

Where did that money come from?

We sometimes agree to receive a portion of royalty interest in the projects we collaborate on. In this case, we monetised a portion of our royalty interests in the cancer medicine Keytruda (pembrolizumab) in 2019, which we humanised antibodies for.

Managing our investment portfolio

We seek to outpace UK annual wage inflation by 3.5% per year, over the long term. The returns on our investment will be used to fund future translational activity.

As long-term investors, we invest in a diverse portfolio to spread our risk across many asset classes. These include global equities, fixed income investments, private markets, infrastructure, real estate and hedge funds.

LifeArc Ventures

Our LifeArc Ventures team invests in early-stage, life science companies that deliver both positive impact for patients and provide us with long-term financial return.

Other sources of income

We also have income stemming from service agreements, royalties, and milestones.

Through these sources, we are self-sustaining and can continue to invest in promising science.

For more on our investment policy and where we spend our money, view our annual reports and accounts.

Latest news

-

LifeArc launches £40m research centres that will unlock new tests, treatments and cures for people living with rare diseases

Read more: LifeArc launches £40m research centres that will unlock new tests, treatments and cures for people living with rare diseases -

First-of-a-kind plan announced to get more children access to cutting-edge, proven gene therapy treatments for rare diseases

Read more: First-of-a-kind plan announced to get more children access to cutting-edge, proven gene therapy treatments for rare diseases -

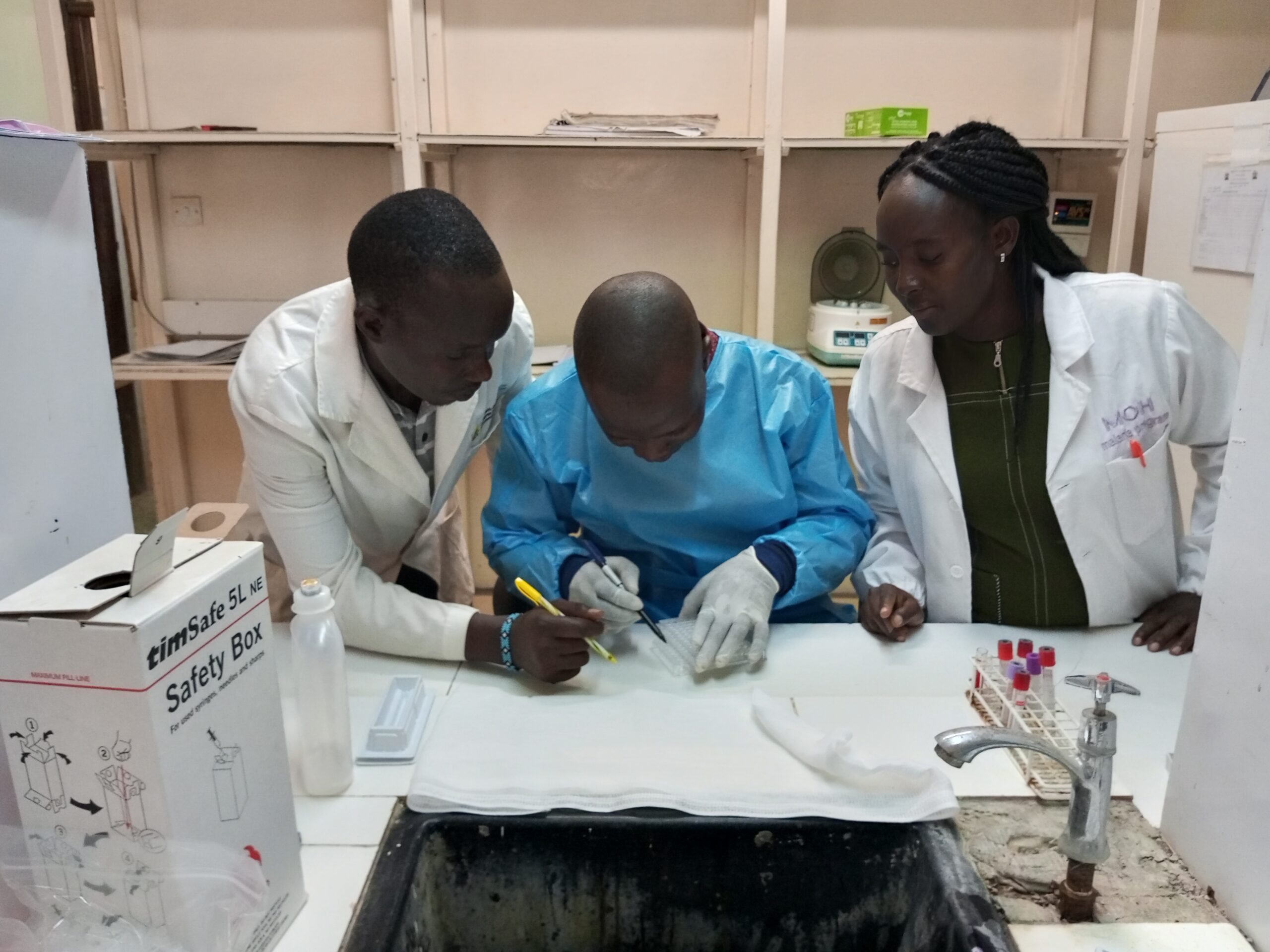

New £6.2m partnership will help to eliminate a deadly disease affecting children and vulnerable people in Kenya

Read more: New £6.2m partnership will help to eliminate a deadly disease affecting children and vulnerable people in Kenya